They remit the 20000 GST in their February monthly activity statement. A registered person is entitled to claim bad debt relief even though the bad debt is not written off from his books.

Realtimme Cloud Solutions Helpfile

Ad One Low Monthly Payment.

. Obtain GST registration number from customer who already registered under GST Act. You have supplied goods or services for a consideration in money and have accounted for and paid GST on the supply. GST Advisor 1 Go to GST 2 Click GST Advisor 3 Enter the GST Submission Period 4 Click Get Advice 5 Go to Bad Debt Relief AR tab 6 Tick the documents that wants to create GST bad debt relief journals 7 Click Create Bad Debt Relief.

You can claim GST relief on your bad debts if you meet the conditions and requirements under the GST General Regulations. Your claim will be subject to our verification should we conduct an audit on your claim. This feature supports bad debt relief for GST Return for Singapore.

AFCC BBB A Accredited. Landlord Pty Ltd is registered for GST and accounted for GST on the supply of the commercial premises in its March 2020 activity statement. However Company B goes bankrupt before Company A can collect any of its money and has to write off the full 2260 balance to bad debt.

In March they cancel the concert and refund all ticket holders 110 each. Apply for a Consultation. If the debt is written off in the same income year as it became a bad debt that is before 30 June 2020 Landlord Pty Ltd can claim a deduction of 15000 for the bad debt written off.

Given VATGST is levied on gross revenue any irreversible VATGST liabilities arising from bad debts could have a crippling impact on businesses. In February they sell 2000 tickets for 110 each including GST. Therefore GST already paid on bad debts as used in the trade parlance cannot be adjusted.

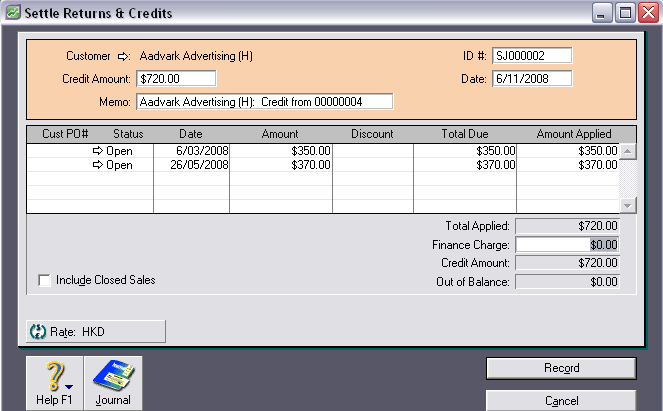

Track Bad Debt Recovered- Once customer return a payment system could identify it as a bad-debt and then recover it. Note that it is six calendar months and not 6 months from date of invoice. Do not submit this checklist unless requested by us.

Company A can get back the 260 HST it paid at the time of the sale. Johnny K Entertainment intends to hold a concert in April. It is calculated as follows.

Then user will be able to do Bad Debt Relief. Get a Savings Estimate. Look for Customer Aging Report Detail to identify which customer owed us more than 5 months month of six stated in GST Act.

When do you account for the adjustment. You have written off the whole or any part of the consideration for the supply as a. Forgot to File Your Taxes.

Once invoice is issued you would pay the gst. Bad debts relief Bad debt relief is given to the Taxable Person in situation where no payment was received after 6 months from Date of Supply. You may proceed to include the amount in Box 7 of your GST return.

Ad Dont Waste Money and Time Fighting the IRS Alone - Choose the Best Tax Relief Services. Recap of GST Treatment for Bad Debt Relief Value of the Bad Debt Relief If only part payment has been received by a registered person then the bad debt relief is only restricted to the balance payment that has not been received. Company A can then make an adjustment of 260 to reduce the HST remittance at any time in.

BBB A Accredited Companies. If bad debts are on account of deficiency in supply of services or tax charged being greater than actual tax liability or goods returned GST paid on the same is refundable subject to fulfilment of the prescribed conditions. You can do a self-review to determine if you are eligible to claim bad debt relief by using the checklist Self-Review Of Eligibility In Claiming Bad Debt Relief.

If After 6 months no payment was made for the Invoice. Our Certified Debt Counselors Help You Achieve Financial Freedom. If you satisfy all the conditions you can proceed to make a claim by including.

Therefore you attribute the. National Debt Relief is Our Highest Rated Debt Relief Company on All the Parameters. The other hand those jurisdictions which do not provide bad debt relief seemingly.

If you have made bad debt relief claims in Box 7 please indicate Yes for Box 11 and the amount claimed. When debts cannot be recovered you can apply for bad debt relief to recover GST that is charged but unpaid by your customers. Bad Debt Relief for GST Return.

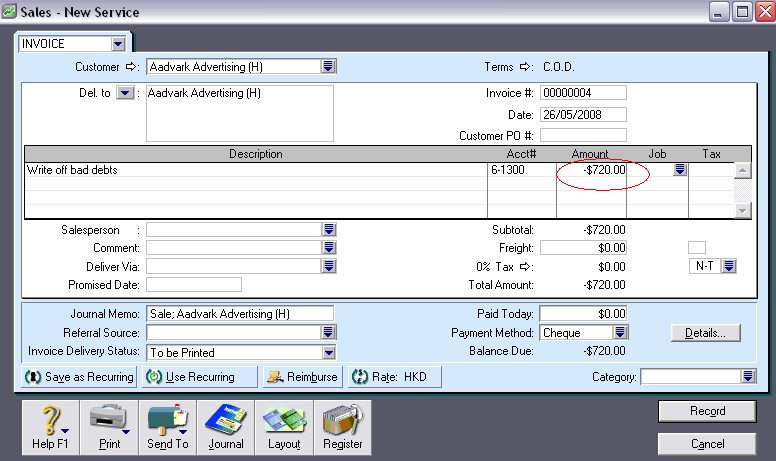

Are you considering the solutions of a financial debt settlement company financial debt negotiation consolidation or a tax obligation financial debt alleviation company gst bad debt relief. Rated 1 by Top Consumer Reviews. GST-Bad Debt Relief - Accounting Entry When you are Selling goods to customer with a Tax Invoice the double entry will be- Dr Debtor 212000 Cr Sales 200000 Cr Output Tax 12000 If you have not received any payment from this customer after 6 months.

This relief is allowed on condition that GST has been paid and sufficient efforts have been made to recover the debt. Bad Debts GST Implications COVID-19 Reduction in output tax liability Section 34 of CGST Act Legal Text 1 Where one or more tax invoices have been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply or where the goods supplied. For the debt to be considered bad it needs to be overdue for 12 months.

For the purposes of GST in Malaysia Bad Debt Relief refers to any amount owing on an invoice that has not been paid or has been partially paid after six calendar months from the date of issue. 260 x 2260 2260 260. How Bad Debt Relief Works.

You have to meet the following conditions to qualify for bad debt relief. A common mistake is to make the claim 6 months after the date that the invoice in question was raised whereas it shouldnt be made until 6 months after the date the invoice was due for payment. You attribute an adjustment to the tax period in which you become aware of it.

For unsecured debts such as charge card personal financings certain personal trainee car loans or other similar a financial obligation relief program might offer you the solution you. The GST adjustment is to take place in the period when the bad debt is written off or when the owner becomes aware that the debt is bad. A GST registered business can claim bad debt relief GST Tax amount paid earlier to Kastam if they have not received any payment or part of the payment from their debtor after 6 th months from the date of invoice.

An Tax Debt Relief Company Can Help. From a policy perspective there are really two main schools of thought around the treatment of bad debts. Goods and Services Tax Explanatory Notes on.

Ad Free Independent Reviews Ratings.

1 Goods And Services Tax Gst Introduction To Gst Ppt Download

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download

Gst Paid But Debtor Become Bad Debt Gst News 284 Youtube

Writing Off Bad Debts Myob Essentials Accounting Myob Help Centre

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Autocount Tips Outstanding Invoice Not Shown In Gst Bad Debt Relief Ideal Count Solution

Syntax Technologies Sql Gst V11 Bad Debt Relief Youtube

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download

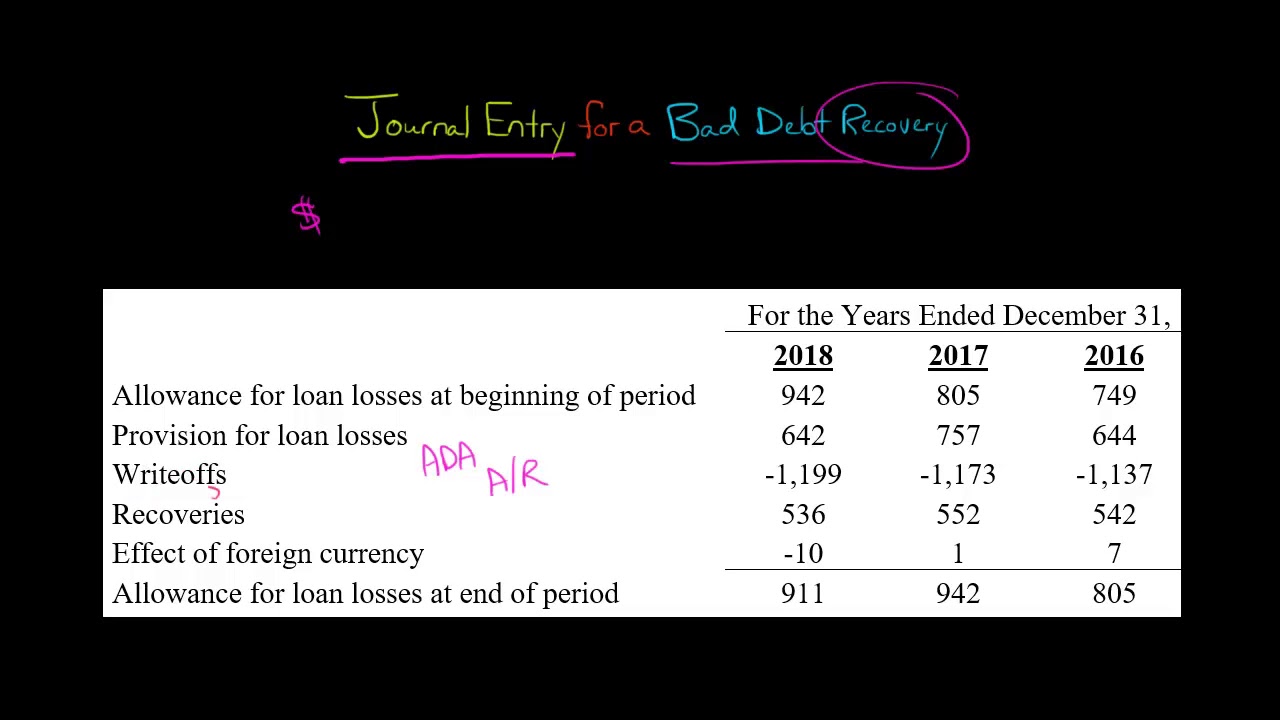

Journal Entry For A Bad Debt Recovery Youtube

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download